STORY HIGHLIGHTS

- The 17.2% who report struggling is lowest since 2008

- Blacks more than twice as likely as whites to report struggle

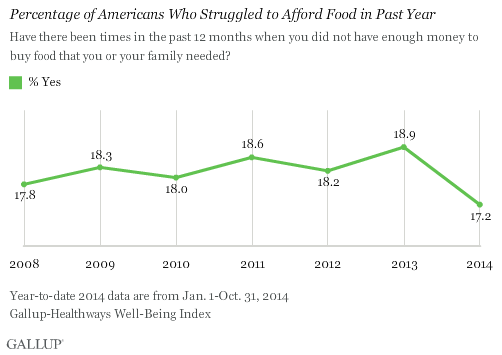

WASHINGTON, D.C. — Fewer Americans say they are struggling to afford food now than did so during the depths of the recession. On average, 17.2% of U.S. adults so far in 2014 report that in the last 12 months they have struggled to afford food for themselves or their families. This percentage is on track to be the lowest measured since the Gallup-Sharecare Well-Being Index started in 2008.

This year’s decrease in the percentage of Americans reporting a struggle to afford food is a positive sign that the economic recovery now could be reaching those who previously struggled to afford the basics. Furthermore, while food prices increased more in the first six months of 2014 than they did for all of 2013, this does not appear to be resulting in more Americans struggling to afford food.

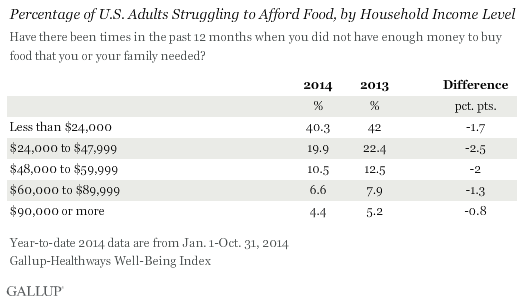

Earning at Least $24K Reduces Likelihood of Struggling to Afford Food

While the percentage who lack enough money to buy food at all times over a 12-month period is directly related to household income, earning an annual household income of at least $24,000 significantly reduces the likelihood that individuals will struggle to pay for the food that they or their families need. Those whose households earn $24,000 to $47,999 a year are half as likely to report struggling to afford food as those who earn less than $24,000, 19.9% vs. 40.3%, respectively. The rate is cut in half again at the next income level, with 10.5% of those earning $48,000 to $59,999 saying they lacked enough money for food. The rate continues to diminish at higher income levels, although not as steeply.

Since 2013, the percentage of Americans struggling to afford food has declined in each income group. The drop was highest among Americans whose household annual income is between $24,000 and $47,999. The improvement across all income groups indicates that the economic recovery is not only reaching upper-income Americans, but it also seems to be benefitting those with lower incomes, at least when it comes to affording food.

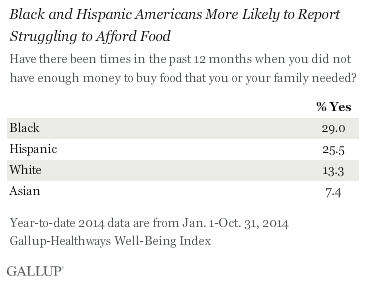

Blacks More Than Twice as Likely as Whites to Struggle to Afford Food

Across racial and ethnic groups, blacks are the most likely to report struggling to afford food, followed by Hispanics. These groups are about twice as likely as whites to report lacking the money they need to buy food for themselves or their families. Asians are the least likely to report struggling to afford food.

This pattern may be partially related to income. Black households make 67% of the national average. According to the U.S. Census Bureau, in 2013, the median household income among whites was $58,270, while it was $40,963 among Hispanics and $34,598 among blacks. It was highest among Asians, at $67,065.

Bottom Line

Americans are less likely to say they are struggling to afford food so far in 2014 than they have said so in the past five years. The percentage of Americans who say they lacked enough money to afford food over the previous 12 months has returned to prerecession levels, an encouraging sign that those who previously struggled to meet their basic needs may be feeling the positive effects of the recovery.

Fewer Americans are unemployed or underemployed in 2014, which may be related to the improvement in Americans’ struggles to afford food. On average, Americans spend about 10% of their disposable annual income on food, according to the U.S. Department of Agriculture. The improvement in 2014 could mean that Americans have more disposable income to spend on food, reducing affordability struggles. Or it is possible that if other expenses are down, such as lower gas prices, Americans can simply put more of their disposable income toward food.

SURVEY METHODS

Results are based on telephone interviews conducted Jan. 1- Oct. 31, 2014, as part of the Gallup-Sharecare Well-Being Index survey, with a random sample of 148,854 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±0.3 percentage points at the 95% confidence level.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the Gallup-Sharecare Well-Being Index works.